Order types

This section describes the types of orders available in ProRealTime.

Simple orders

- At market order

An "At Market" order, is an order to buy or sell at the current market price (with no price limit). It may be executed as long as there is sufficient quantity available to buy or sell.

An "At Market" order may be the object of multiple partial executions, depending on market possibilities.

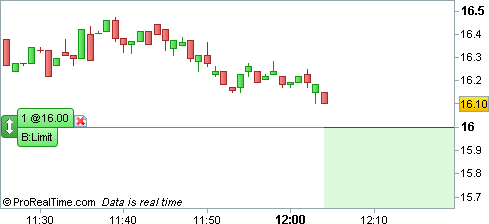

- Limit order

A Limit order specifies the maximum price at which you agree to buy the securities or the minimum price at which you agree to sell them.

Limit orders placed by clicking on charts will be buy orders if placed below last price and sell orders if placed above last price. If you want to place a buy limit above price or a sell limit below price, this can be done via the order book or order tickets.

Example: For a Limit order with a price of 16€, the order may be executed at the best price available at or below the 16€ price level, represented by the green shaded area.

- Stop order

Stop orders may be executed if the market reaches or passes the price level of the order. If the market trades at or beyond the trigger price, the order is triggered as an "At Market" order: it is filled at the best price available, but not necessarily at the stop price.

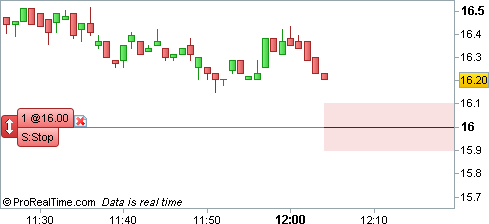

Example: for stop orders placed at 16€, the order will be triggered only if price reaches or passes the price level, but could be executed at a price above or below the stop as shown below.

- Stop-limit order

A stop-limit order is placed at two price levels (stop and limit). The order is triggered if the market reaches or passes the first price level (stop). Once triggered, a buy stop-limit order can only be executed at a price lower or equal to the second price level (limit). A sell stop-limit order can only be executed at a price higher or equal to the second price level (limit).

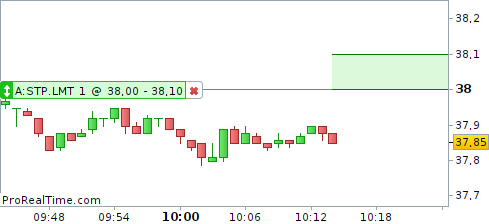

Example: a stop-limit order placed at 38 - 38.10 will be triggered only if the market reaches or passes 38, and can only be executed at a price lower or equal to 38.10.

- At Market If Touched

At Market if touched orders are only available from the executed as "At Market" orders if the market trades at the price of the line on which the order is based.

"At Market if touched" orders will be sell orders if placed above the current price, or buy orders if placed below the current market price.

"At market if touched" orders are available only from the "Advanced interface".

- Trailing Stop (fixed or percentage)

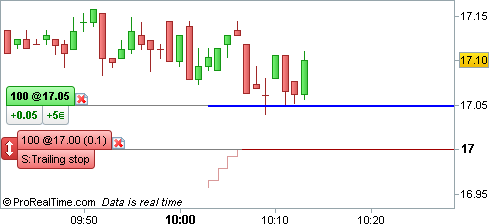

Trailing stops are set at a specific distance (fixed or percentage) from the market price (or from the entry price of your position).

In the case of a sell stop placed below price, if the market price rises, the trailing stop level moves up, to keep the distance originally set. If the traded price goes down, the stop stays at the same level. The order is executed as an "At Market" order if the trailing stop is triggered.

Multiple-leg orders

The trading module lets you link orders. In this section we describe some classic examples of linked orders. In the workstation, these are called "Multiple-Leg orders". This section presents some classic examples of multiple-leg orders, but remember that you can also use them for pyramiding and other strategies. Using the advanced interface, you can create your own customized multiple-leg orders.

- One cancels the other (OCO)

An OCO composed of two separate orders linked together by OR logic association. If one order is completely executed, the other order is canceled.

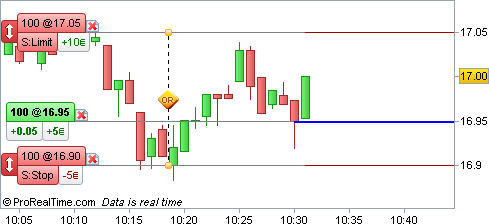

Example: If you already have an open position, an OCO order can be used to place a target and stop. In the image below, there is an open position open at 16.95€. An OCO order is used to place a sell Limit target order at 17.05 and a sell Stop protection order at 16.90. When one of the two is executed, the other will be canceled.

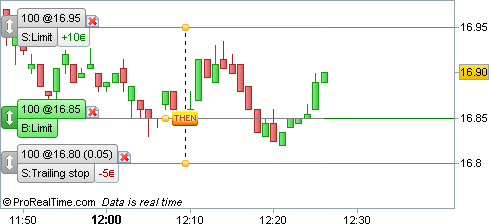

- One enables the others (OTO)

An OTO is composed of a main order and one or two subordinate orders. When the main order is completely executed, the subordinated orders are placed. It is usually composed of a main order that opens a position, a target Limit order and a protection Stop.

Example: We create a strategy composed of a primary order at a limit price of 16.85€, a target Limit order at 16.95€ and a protection Trailing Stop at 16.80€ If the main order is triggered, the two subordinate orders are set.